How many times have you rushed to work only to realize that you have forgotten your wallet at home? Well, the only option then is to borrow money from your co-workers (for lunch or the odd coffee) and this can be quite embarrassing! And now think about the one thing you never leave home without these days? You guessed it right – your mobile device. People are glued to their smartphones throughout the day and sometimes, even in bed.

The mobile world presents a great opportunity for any seller to accept payments using your mobile phone. If your mobile phone was also your wallet, you would never have to carry your “real” wallet.

Just out of a curiosity to see how such a concept would work, I decided to install a mobile payment app on my Android phone.

Setting up Mobile Payments

Before paying using my smartphone, I had to enable NFC, download the mobile payment app, register my credit card, and configure the app itself.

Following are the step-by-step procedures:

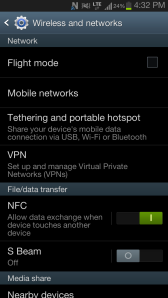

1. Enable NFC: First, I enabled the Near Field Communication (NFC) feature on my Android phone. NFC allows smartphones to communicate with other devices in the vicinity. The communication is encrypted. Smartphones that do not have NFC cannot be used for mobile payments (for example, the iPhone). As soon I enabled NFC, a N sign appeared on the top of the screen.

2. Download the Mobile Payments App: I downloaded the CIBC mobile payments app. You can download the mobile payments app for your credit card/bank.

3. Call the bank to activate: There was a manual process involved with CIBC. I had to make a phone call to CIBC to activate mobile payments for my credit card.

4. Receive notification from CIBC Mobile Payments: Once I received the notification, I knew the activation was successful.

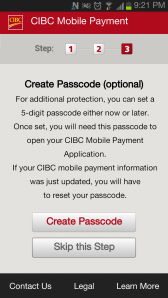

5. Set a password: This step is optional. For security reasons, it is better to set a password – just in case your mobile phone is lost or stolen.

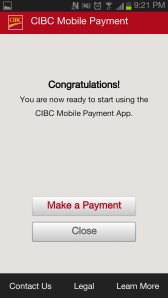

The configuration was complete and the app said ‘Congratulations!‘.

Making a Mobile Payment

Once the setup was complete, I tried to figure out how I could make a payment. Surprisingly, making a payment was extremely simple.

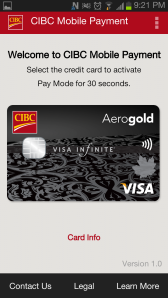

1. Launch the Mobile Payment app (CIBC) on your smartphone. Enter your password if you have set one.

2. Tap the credit card to activate Pay Mode for 30 seconds.

3. Tap your phone on the payment terminal. You can also move your smartphone within 10 centimeters of the payment terminal. The payment is processed.

Security Features in Mobile Payments

The mobile payments app has many security features:

- Call the bank to add your credit card. This ensures someone else is not activating your card.

- Password on the mobile payments app. This is in addition to the password on your phone.

- Pay Mode deactivated in 30 seconds. This ensures that your credit card information is not read from your phone when you don’t want it to be read. You are always in control.

- Communication between the smartphone and the terminal is always encrypted.

Advantages of Mobile Payments

- You don’t need to carry your wallet.

- Reduce credit card theft. Since you are not swiping your credit card anywhere, it cannot be read by hackers.

- Any terminal that accepts VISA payWave® or MasterCard PayPass™ will also support NFC transactions.

Disadvantages of Mobile Payments

- There aren’t many touch-to-pay terminals at the moment.

- Not all credit card companies offer mobile payments.

- Not all mobile carriers offer mobile payments.

- You need a separate SIM card to enable mobile payments (provided by the carrier).

- If smartphones are lost or stolen, the credit card details can be extracted by a smart hacker.

The smartphone industry is growing at an alarming pace. Up until yesterday, your smartphone was your computer, camera, and maybe even your bathroom mirror. Today, smartphones are credit cards and mobile payment terminals. You can now forget your wallet at home and you don’t need to borrow lunch money from your co-workers!

Disclaimer: The Digital Dimension of Technology is an independent technology blog. We have not been endorsed by Rogers, Samsung, CIBC, or Google (Android). We do not endorse the security, usability, and reliability of mobile payments.